Northern Dynamic Datev Connector

Installation

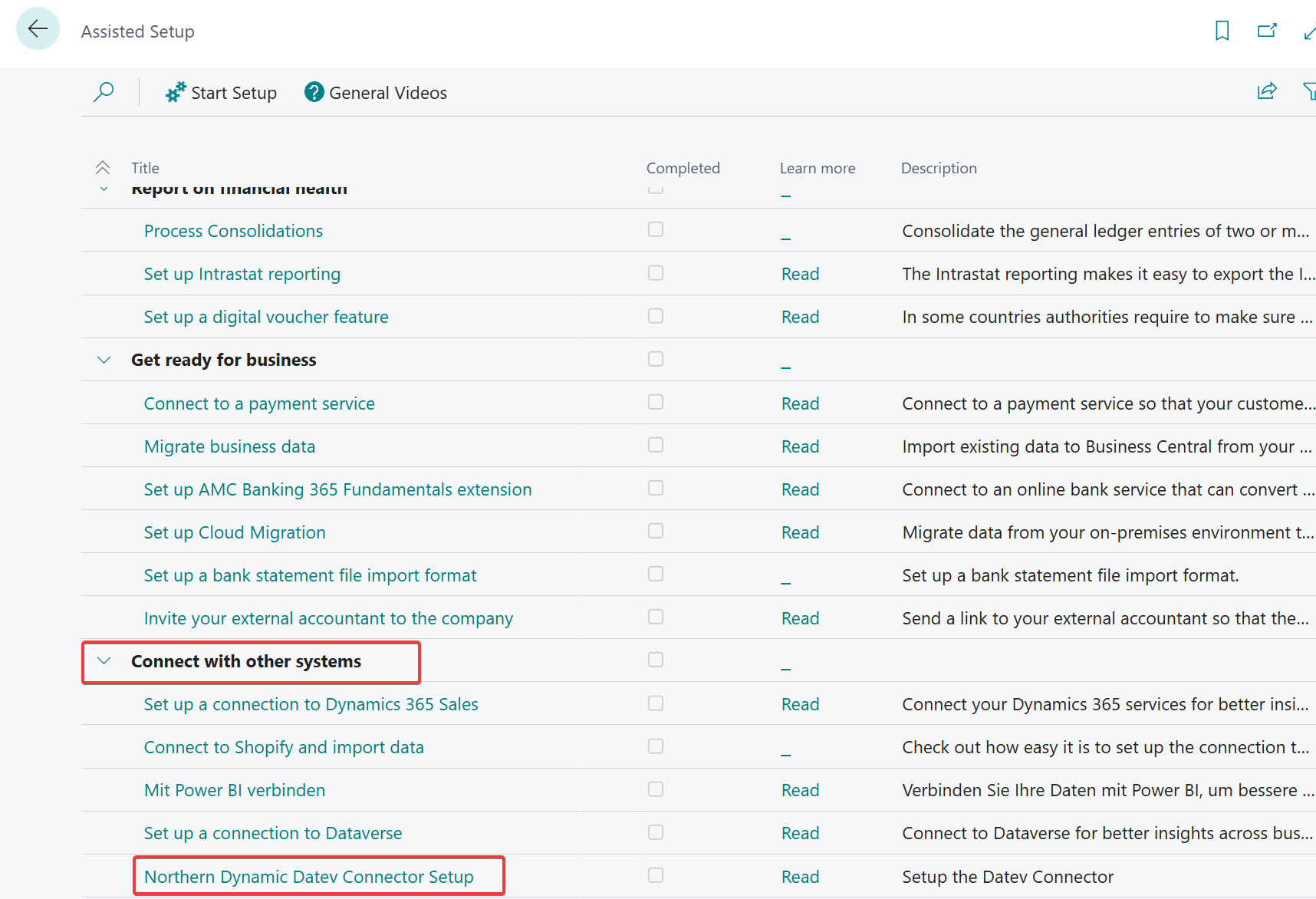

After installing the APP from the AppSource store, you can start with the initial setup by using the Assisted Setup. Find the scection Connect ith other systems and then select Northern Dynamic Datev Connector Setup. This will open a wizard which will ask you for the basic setup questions.

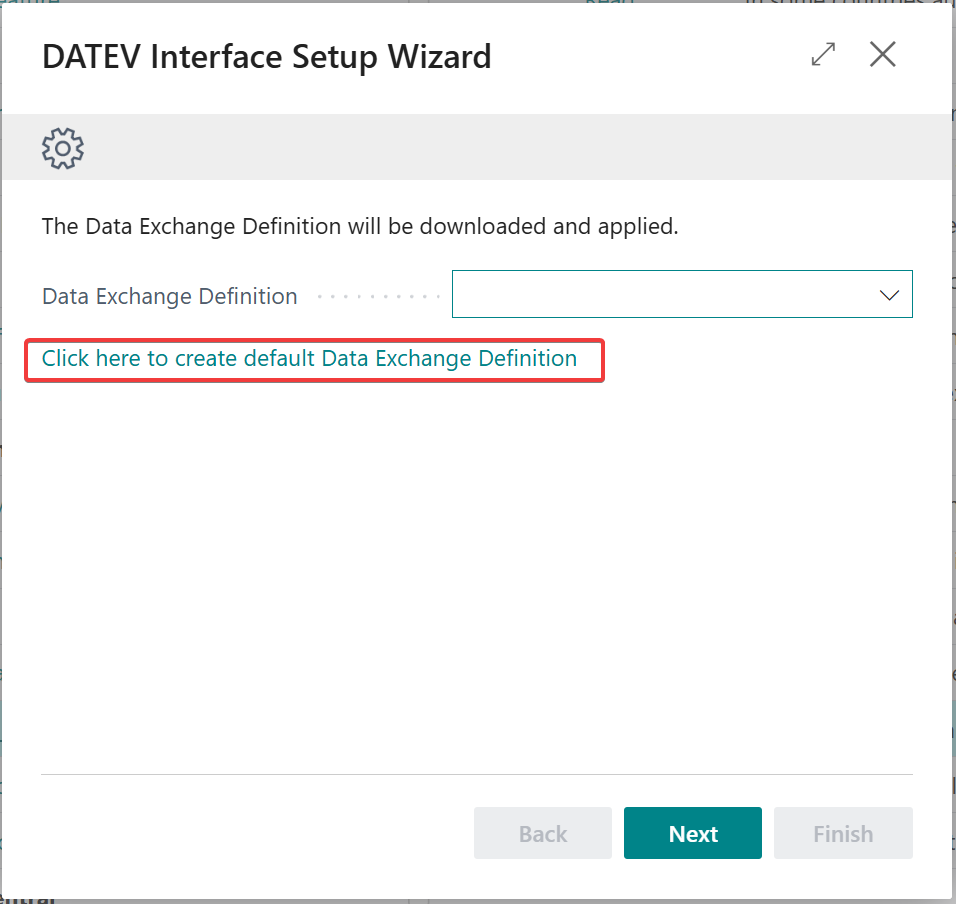

The interface uses the Data Exchange Definition Framework with custom settings and Codeunits to create the files in the needed format. The file might change over time as the interface evolves. At the time of the setup the current exchange definition can be downloaded by clicking the link in the wizard.

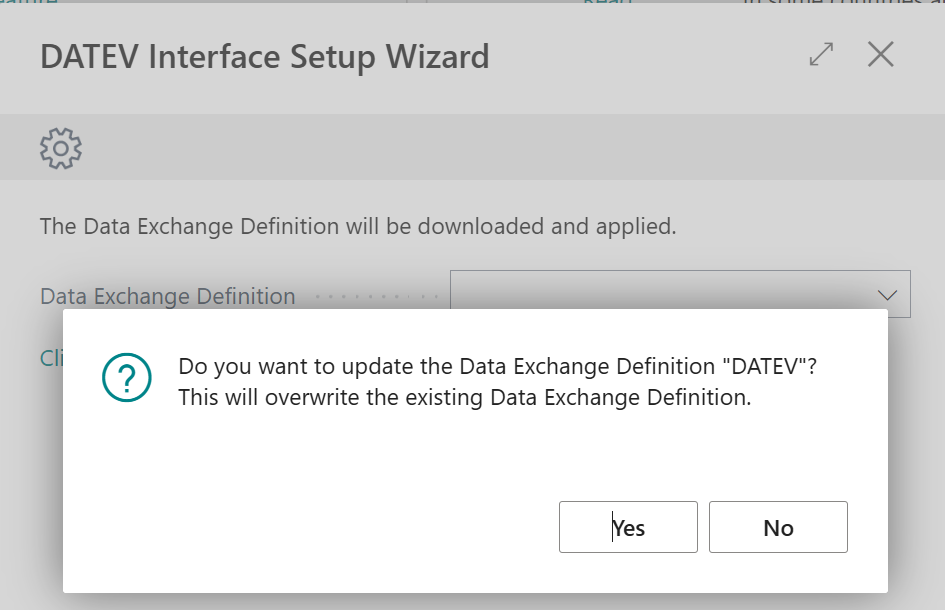

This will create a data exchange definition with the code "DATEV". An exisitng exchange definition with the same code will be overwritten.

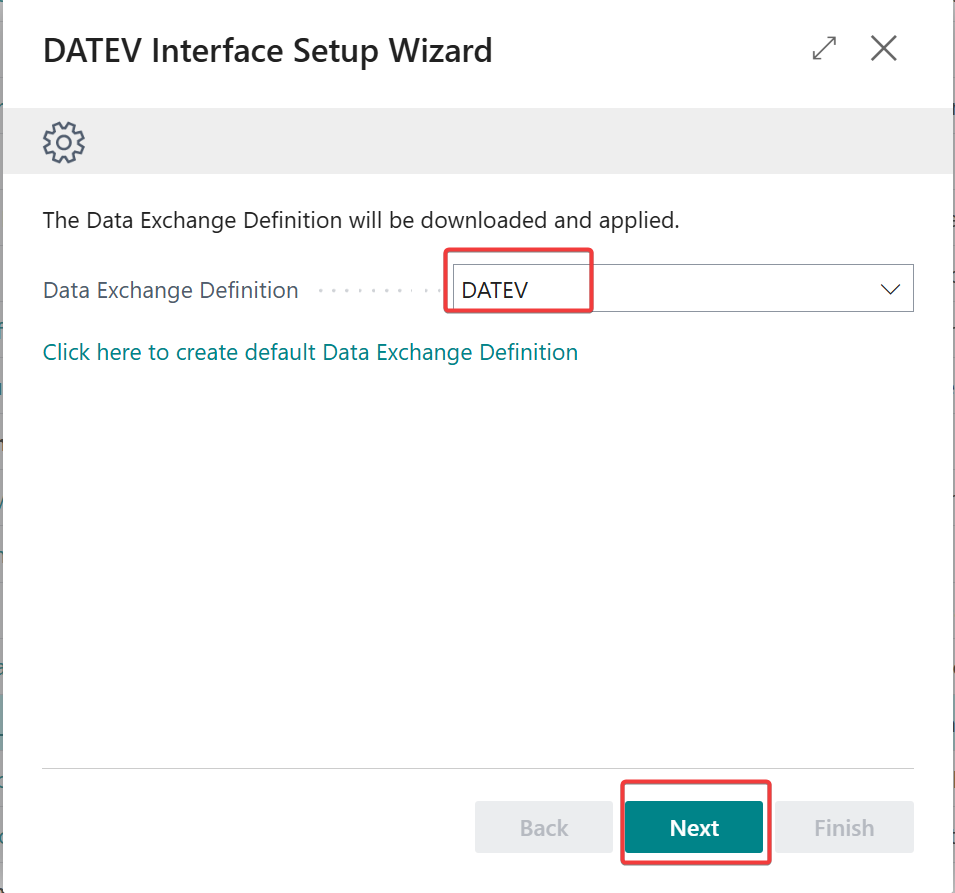

After you have created this, the code will be suggested correctly.

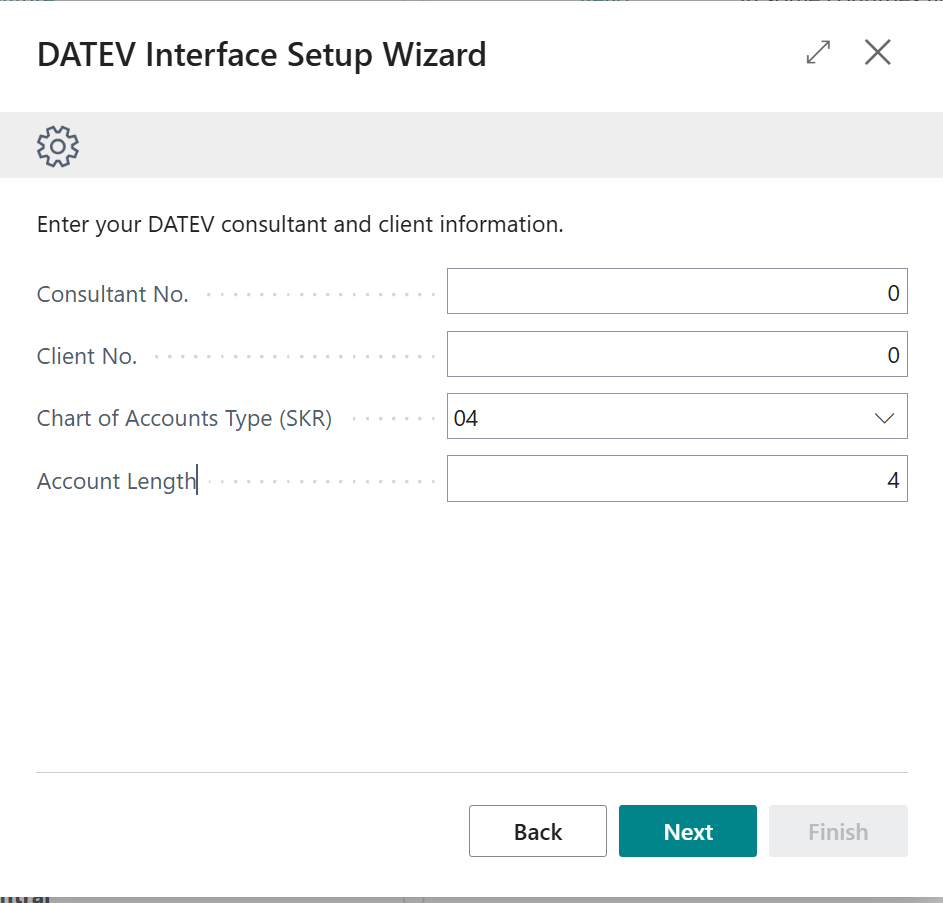

Click Next to continue with the setup. The Consultant No. is the number your Tax Consultant has with the DATEV organization. He should know. The Client No. is the number you have from your Tax Advisor.

Chart of Accounts Type (SKR) you can select either 03 or 04. And the Account Lengh is the lenght in digets for your G/L Accounts. For example if you have accounts like 1000 or 2000 you would put in 4. If you have 10000 or 20000 you would put in 5.

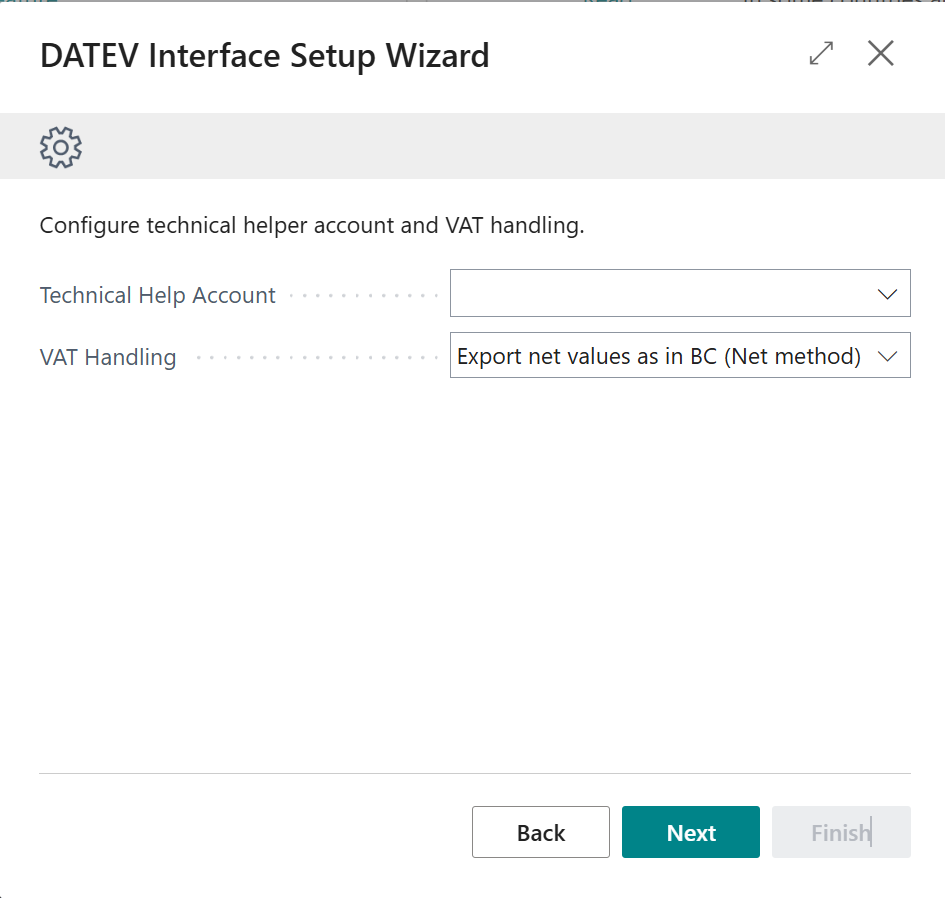

In the next page you have to provde a Techcical Helper Account This has to be the same length as you have selected in the previous step but it has not to be a real account in your Chart of Accounts. The DATEV Software is a bit picky when it comes to balance accounts and posting like you have in Business Central where you have just a number of accounts and some are with positive and some are with negative amounts is "frowned upon". For that we will put this account as a balance account for all lines, when we do have longer split postings. It should be an account which you do not use for example you can put 9999.

VAT Handling is another option you have. If you can talk your tax advisor to disable automatic accounts on his side. You can use the Net method which will export all values as they are posted in business central. If you have a posting with VAT for example an invoice, we will export Net amount, Gross amount and VAT. If your tax advisor wants to use the automatic accounts, you have to select the Gross method then business central will export the gross amounts and the tax advisor software will recalculate the VAT. This will happen based on Automatic accounts and Datev Posting Types which you then also have to setup. Using this method will extend the effort of setting up the interface.

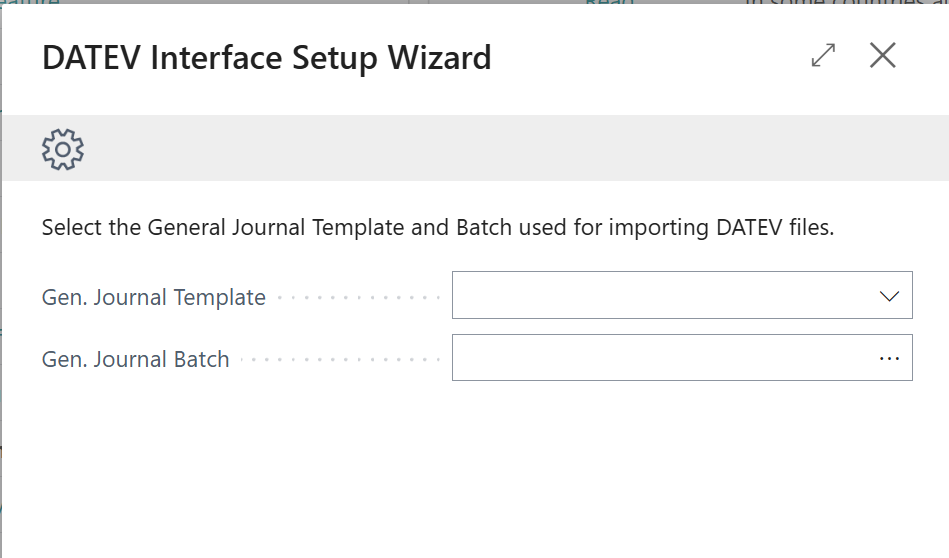

You can also Import files you get from your tax advsior in your Journals. In which journal they should go you setup here in the next step.

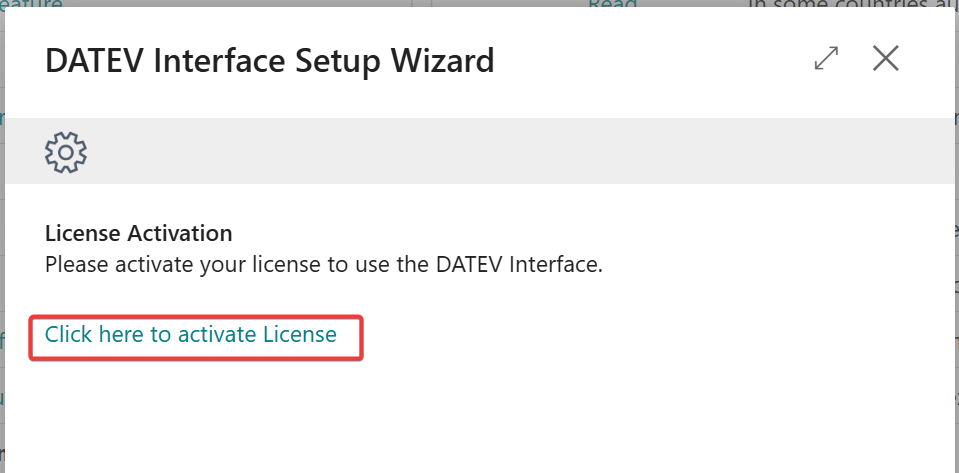

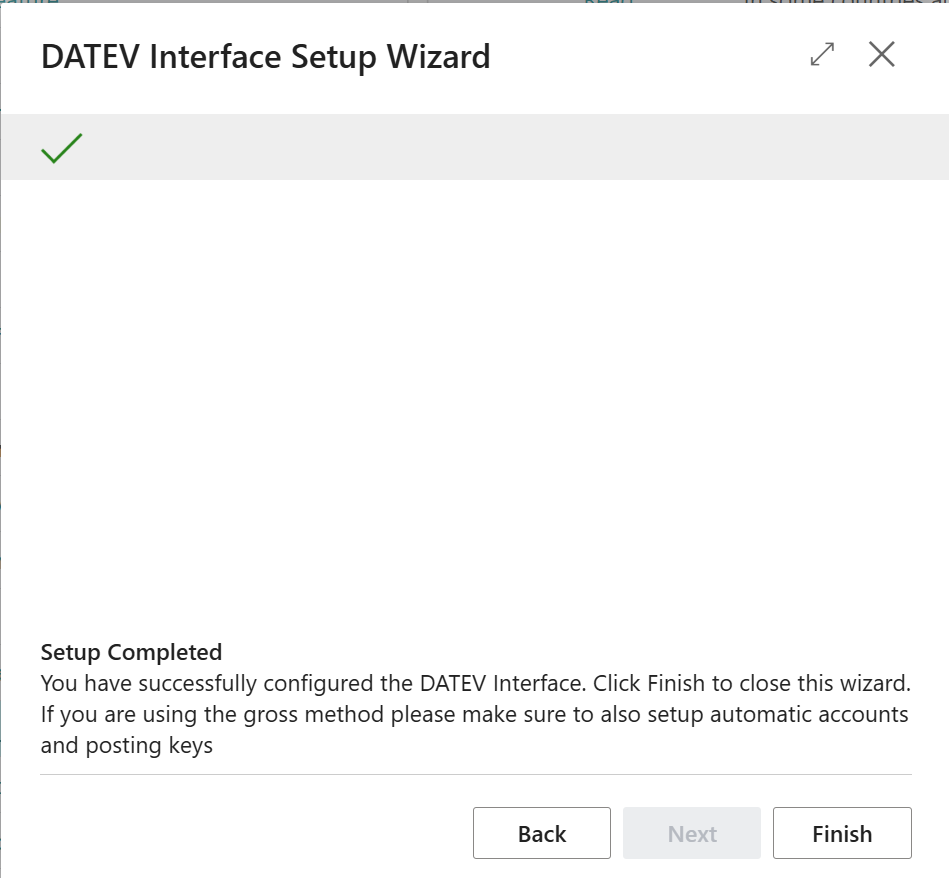

After that you arrive to the next step of the wizard, where you can active a purchased licsense. If you are just trying out the software, you can use it for 30 days. After that the export will stop to work and you need to purchase the app.

After that you are finished and can start using the interface.

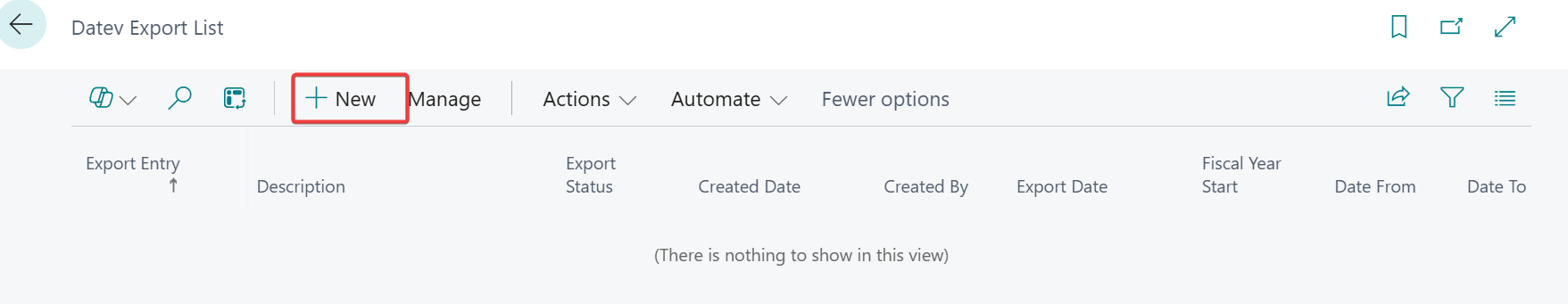

Export Data

In the search bar look for Datev Export List to find the history of all exports you had so far. Click new, to create a new export.

You will automatically get a new Export Entry number and can give a description for the export. That is only used internally. The Status will be set to New. You have to select the Fiscal Year Start and the system automatically will set the end. In the interface only one fiscal year can be exported at a time. You can select the Date From and Date To if you want to export only a portion of the data. If you leave the fields blank a fully fiscal year will be exported.

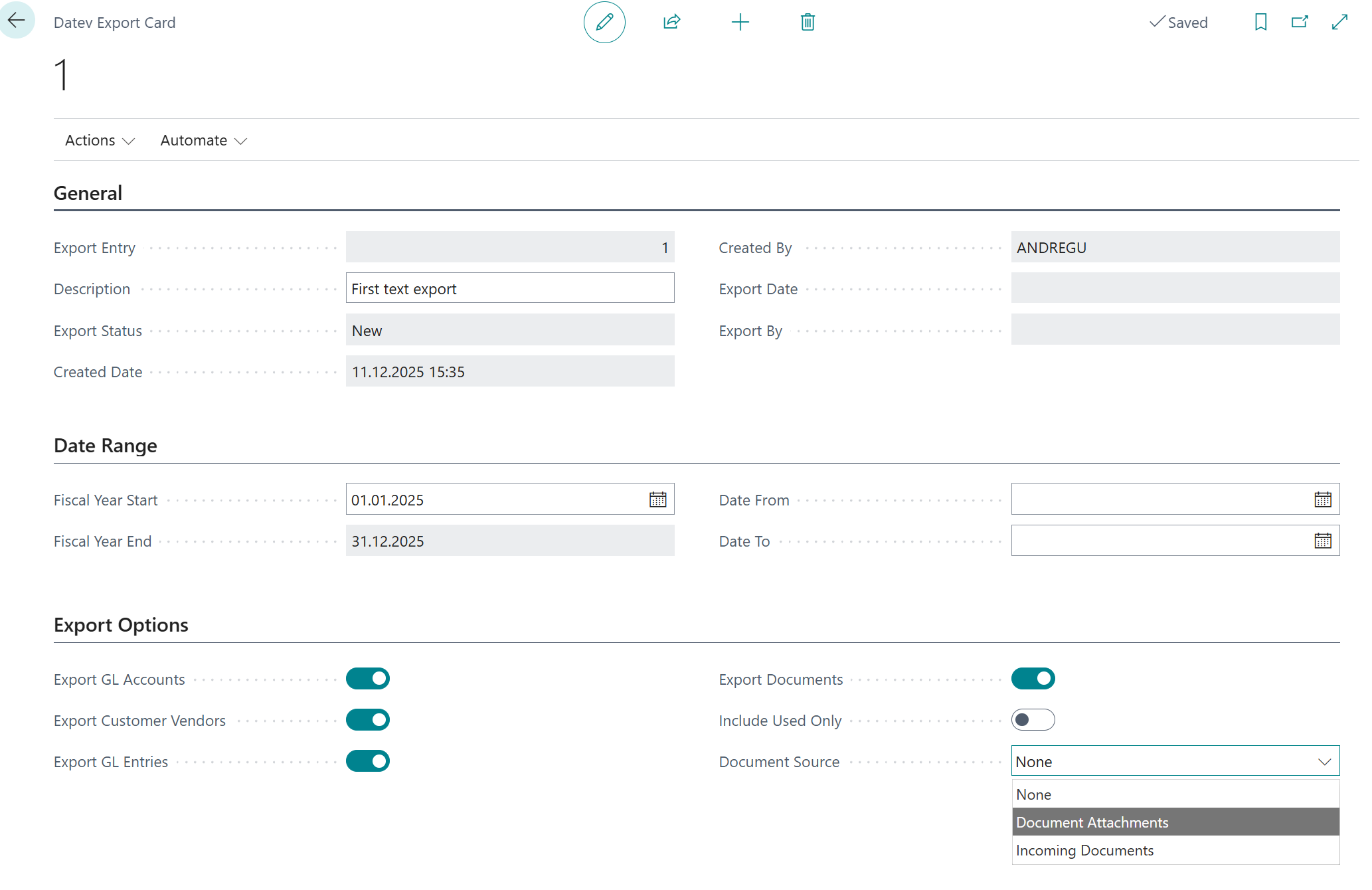

In the Export Options You choose what to export. There is a file for the G/L Accounts and another file for Customer and Vendor master data. The Export G/L Entries is where the entries will go - which usually makes up the biggest portion of the export.

With Export Documents you can also export PDF files of your invoices if you have stored them in the database. If you select this field you also should select Document Source that will be where the system looks for documents. Two interfaces are there out of the box. One is the Document Attachments and the other is the Incoming Documents. If you have a different system, you can talk to your partner. It is possible to create an interface for other doucment management systems as extension and then you can select that also. If you select documents, you will get more files in the export. A zip file containing all the PDFs with a unique name and and XML file having the links to the file which then again are references in the Entries export. In other words if you tax advisor imports the files with documents he has full insights in your entries and no need of exchanging folders anymore.

If you have a lot of documents stored, you can consider exporting month by month to keep the filesize smaller.

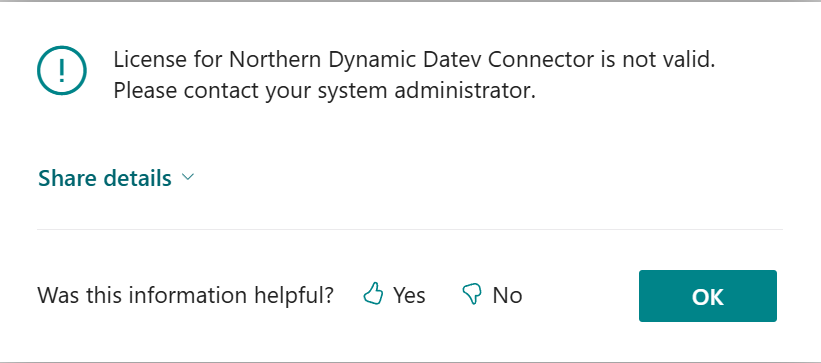

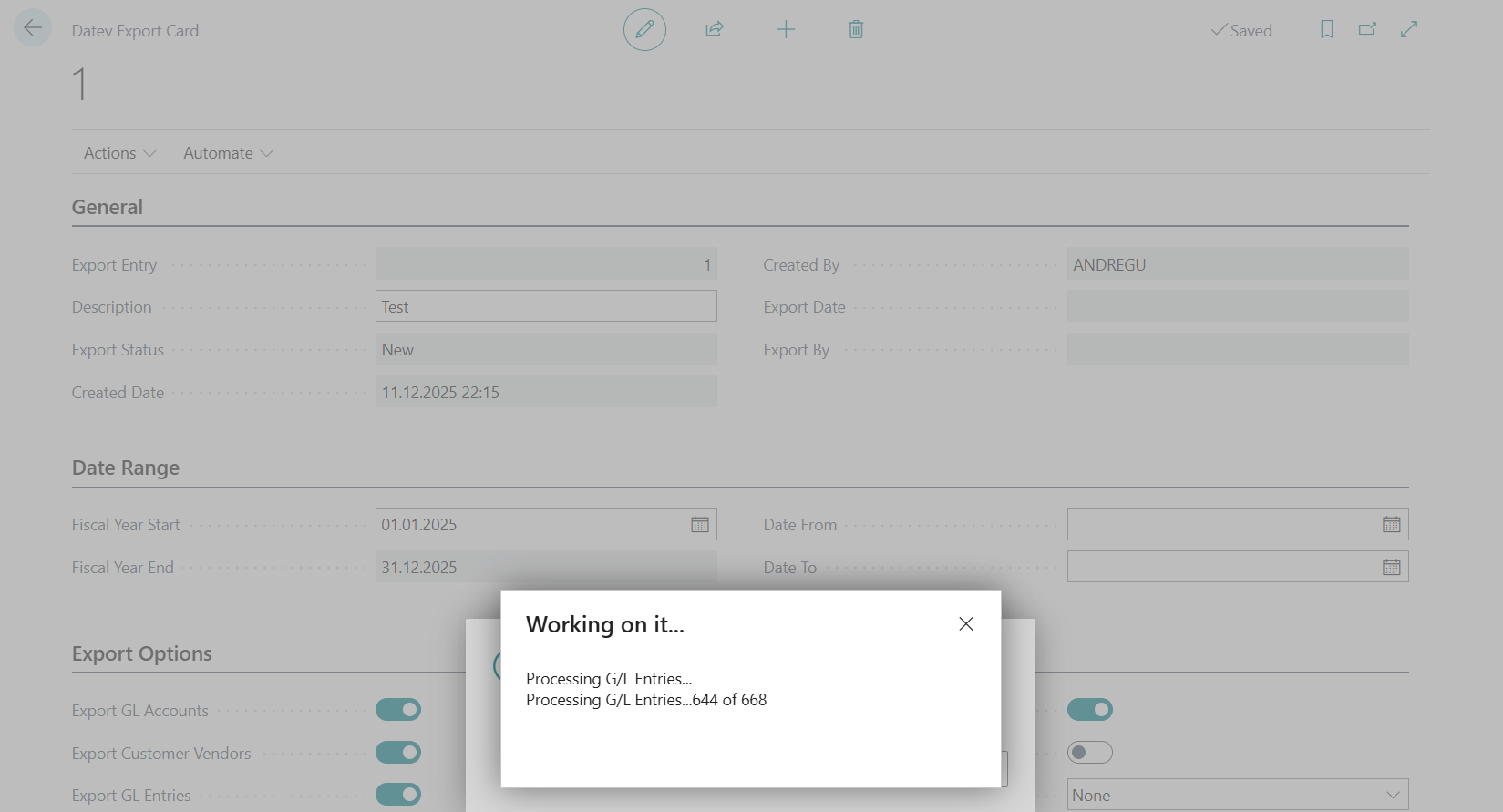

If you have selected all your options go to Actions and Start Export and then answer Yes. If you have no valid license or it is expired, you will get an error message at that point in time.

You can check Northern Dynamic Licensing to see how to activate the license after purchase.

If you have a valid Test or Production license. Your G/L Entries will be preprocessed to match the format.

If everything worked fine, you will see a confirmation message.

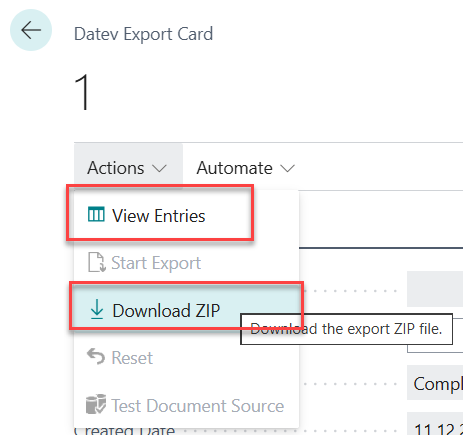

If you use Actions and View Entries you can view the table where the export was prepared.

With Actions and Download ZIP you get the file you can send to your Tax Advisor. If you have selected to export also Documents you will also have a zip file within that zip file containing all the documents. NOTE if you have multiple documents attached to a posting only the first document will be exported. This is a limit in the capabilities of the interface.